Key features

Benefits

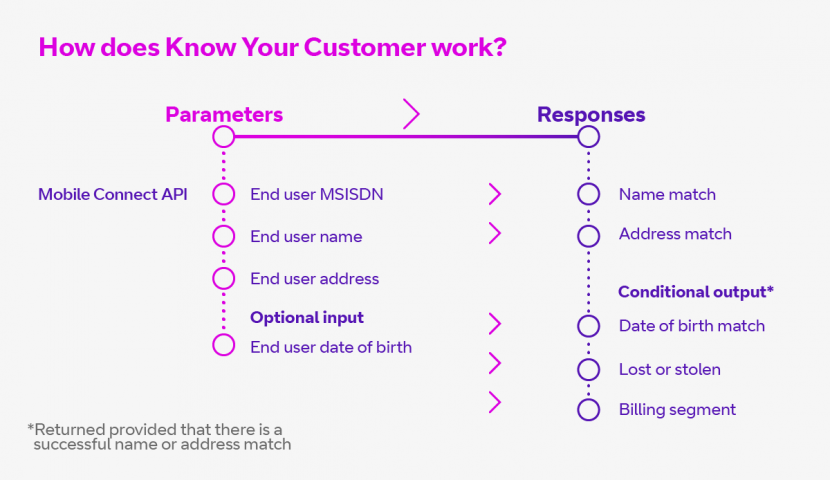

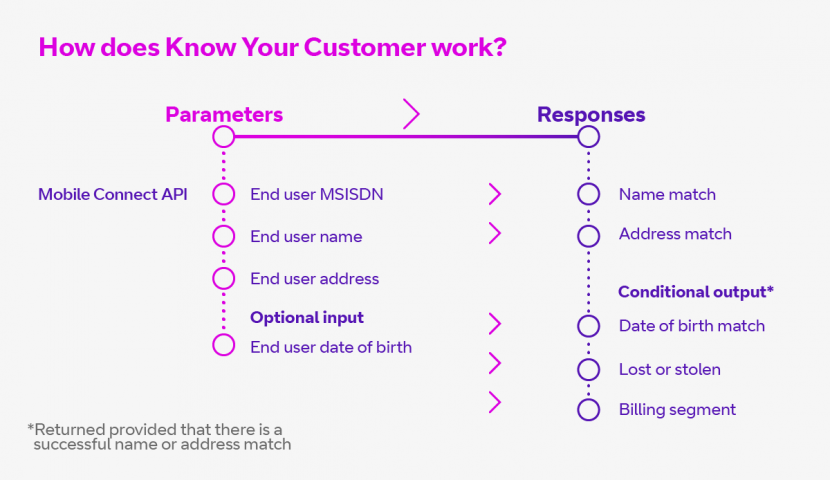

How does it work?

Ideal for:

APIs Included

EE

BT

Know Your Customer

Identity and Authentication

Digital Identity

Whether it’s for shopping, travel or banking, customers are increasingly using their devices to get things done online. Many of these involve an initial account setup, which can be time consuming – and in the past, it’s been possible to set up accounts fraudulently using other people’s details.

Know Your Customer (KYC) match offers a mechanism through which a service provider can submit end user (customer) information to validate such as name, address, mobile telephone number to a mobile network operator for...