Key features

Benefits

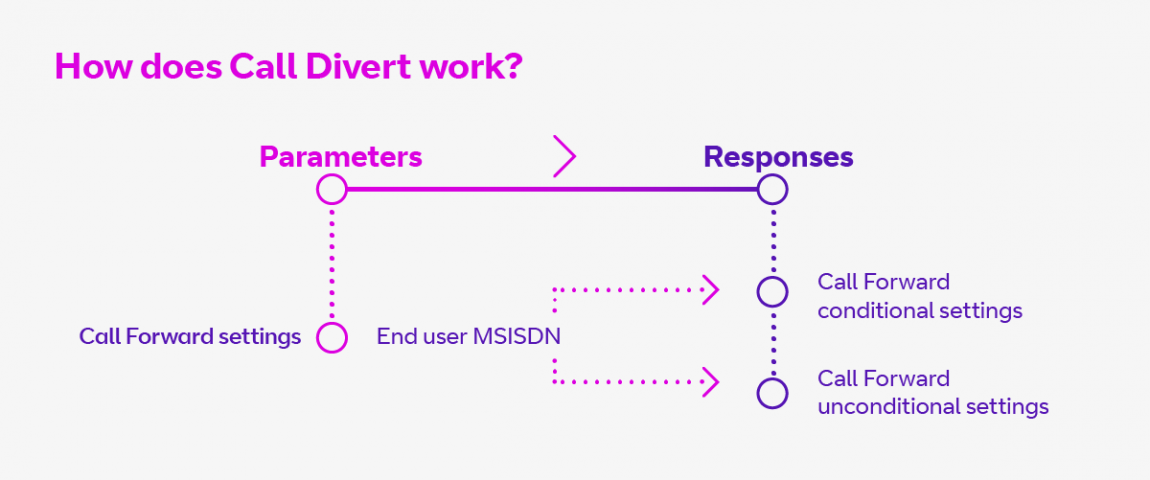

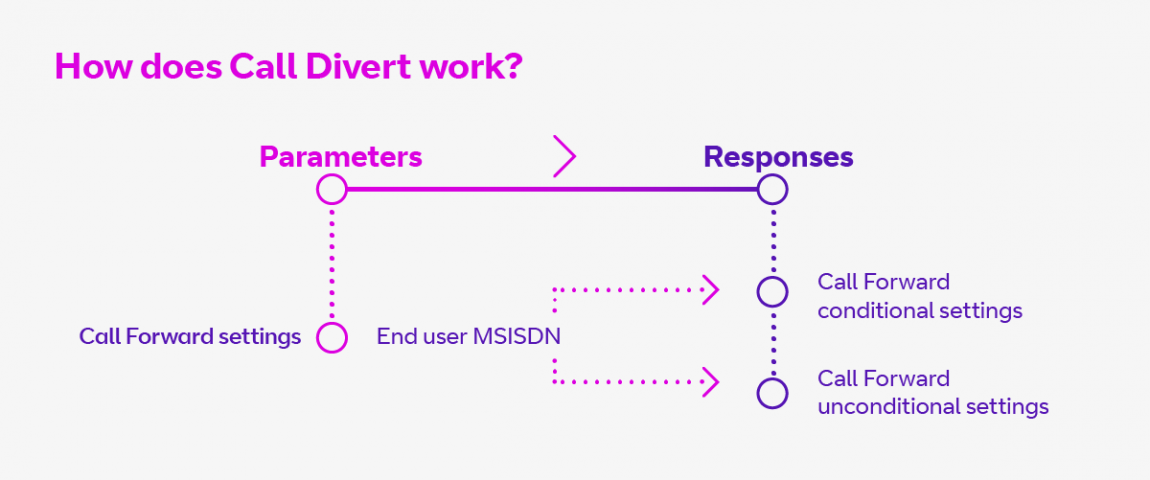

How does it work?

Ideal for:

APIs Included

EE

BT

Call Divert

Messaging and Communication

Digital Identity

As the number of digital transactions made around the world grows, so does the risk of account takeover. Where one-time passcodes are sent by voice, our Call Divert product can help. It confirms an outbound call is going to its intended number, and isn’t being diverted to a potentially fraudulent one – giving customers more security and greater peace of mind.

This product confirms an outbound call is going to its intended number, and isn’t being diverted to a potentially fraudulent one – giving customers more security and greater peace of mind.